Alts: More Liquid Than You Might Expect

Liquidity can be a concern for investors looking to deploy meaningful capital in digital assets. However, as the market has grown and evolved, liquidity across a broader number of tokens has improved, and should not bar investors from looking further out the spectrum of tokens to gain diversified exposure. Mega-cap assets like Bitcoin, Ethereum, Solana, and Ripple show trading volumes in line with the top 25 most traded US public equities, based on 30 day average daily volume (ADV). However, as we have frequently stressed, investors should consider looking past just the largest names in order to capture exposure to the varied themes and opportunities of digital assets. Here, liquidity has also improved.

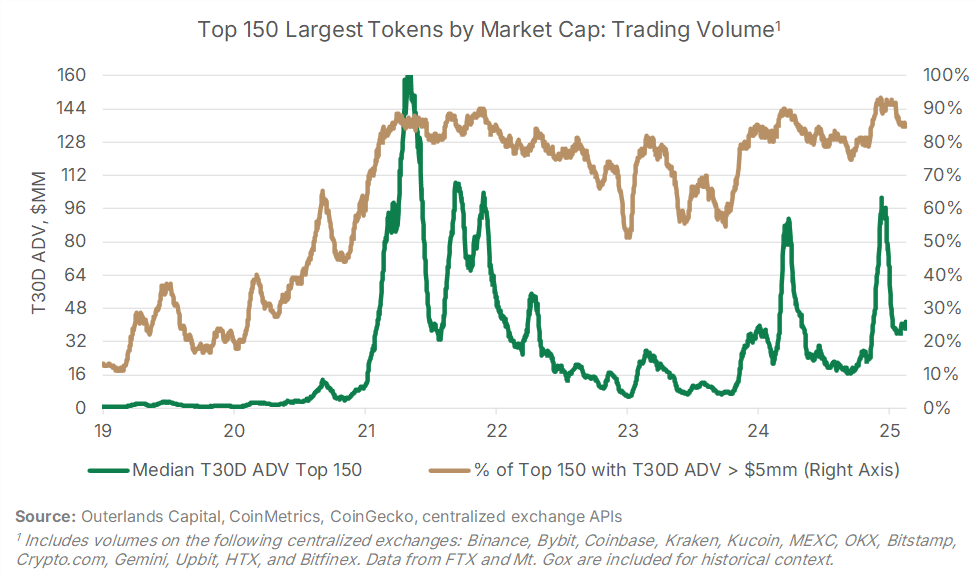

Looking at the top 150 digital assets by market cap, we have seen trading volumes on centralized exchanges increase, to where the median name in the top 150 now has a 30 day ADV of ~$40mm, up from ~$6mm at the start of 2023. What’s more, over 80% of names in the Top 150 have shown average daily volumes of over $5mm over the past 30 days.

While these volume figures are still well below levels on popular US equities, they show that with patience and adequate trading capabilities, it is possible to build positions in smaller tokens. In particular, access to a broad range of global venues is necessary to capture liquidity and efficiently trade a wide variety of tokens.

The opportunities available in the digital asset space are bountiful, and liquidity is becoming less of a barrier to entry.

*The information herein is for general information purposes only, is not investment advice, not an offer of an Outerlands Fund, and should not be used in the evaluation of any investment decision. Such information should not be relied upon for accounting, legal, tax, business, or investment advice. You should consult your own advisers, including your own counsel, for accounting, legal, tax, business, investment or other relevant advice, including with respect to anything discussed herein. An investment involves a high degree of risk including the loss of capital. Past performance is not necessarily indicative of future results.