Contextualizing the Vol Move: Crypto vs Equities

The macro environment has sent global markets into turmoil. Assets have notched extreme price moves across markets, but the relative magnitude of these moves vs history has varied– particularly in the comparison between digital assets and US equities.

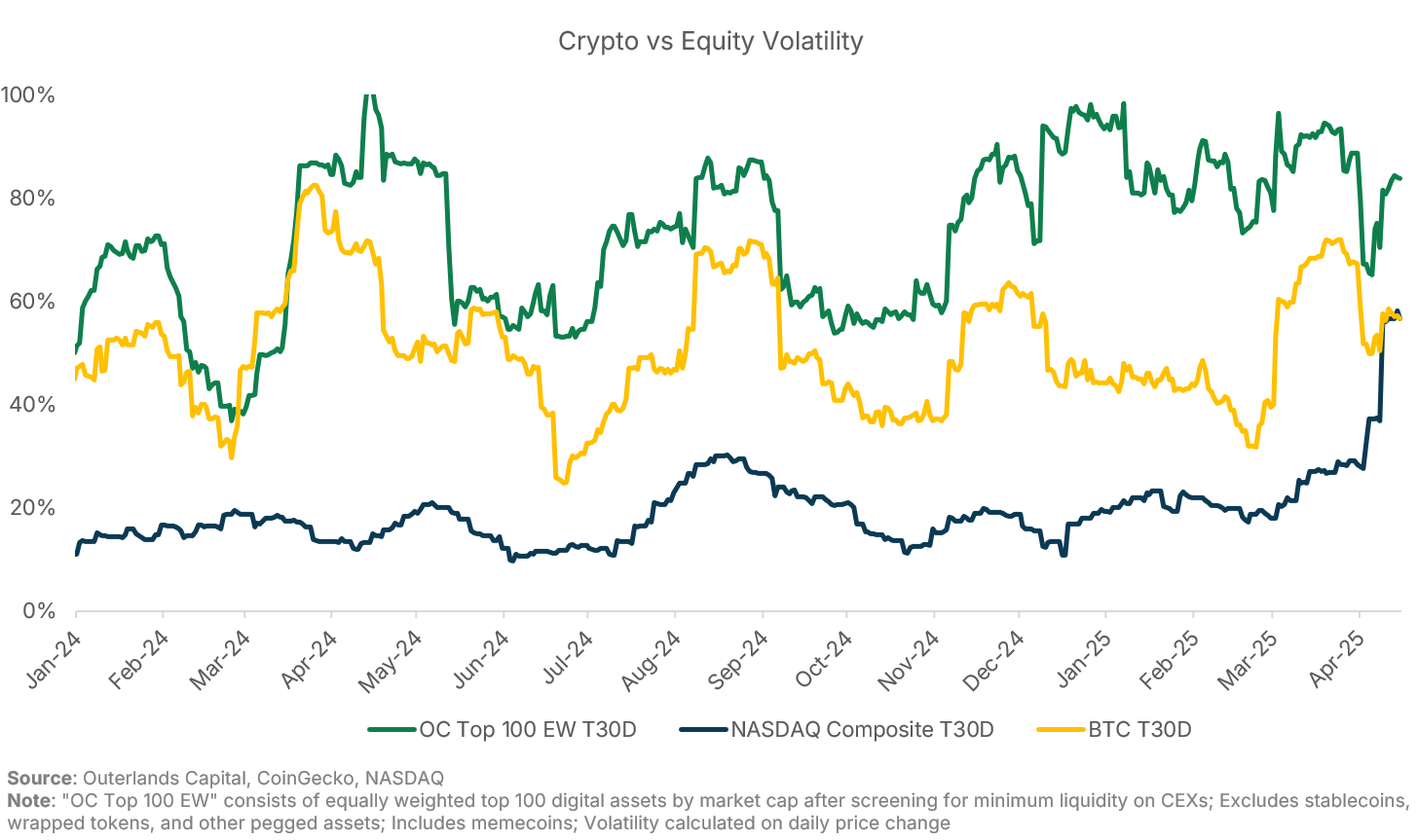

Trailing 30 day volatility for the NASDAQ Composite Index has jumped in-line with the trailing 30 day volatility of Bitcoin (57%, annualized), quickly closing a gap that has averaged >30% over the last year. While moves in the NASDAQ in early April were more than 4 standard deviations vs the prior 180 days, moves in digital assets were closer to 1.5 - 2 standard deviations.

For equities, the spike in volatility harkens back to other calamitous periods, such as the onset of COVID-19, marking fundamental shifts in the economic cycle. For digital assets, the spike in volatility looks like just another bump in the road.

Crypto's relative strength could have some grounding in the long-term fundamental thesis for digital assets. The breakdown of global free-trade principles has profound implications for companies that have optimized their operations for global markets and supply chains. Digital assets, and their related projects and businesses, are also profoundly global, but have been so since the beginning and operate on rails specifically designed to address issues of trust and transcend borders. As economic borders get more pronounced, a global technology designed to be blind to them has the potential to thrive.

*The information herein is for general information purposes only, is not investment advice, and should not be used in the evaluation of any investment decision. An investment in digital assets involves a high degree of risk. Past performance is no guarantee of future results.