Crypto Relative Value: A Lindy Effect in Crypto?

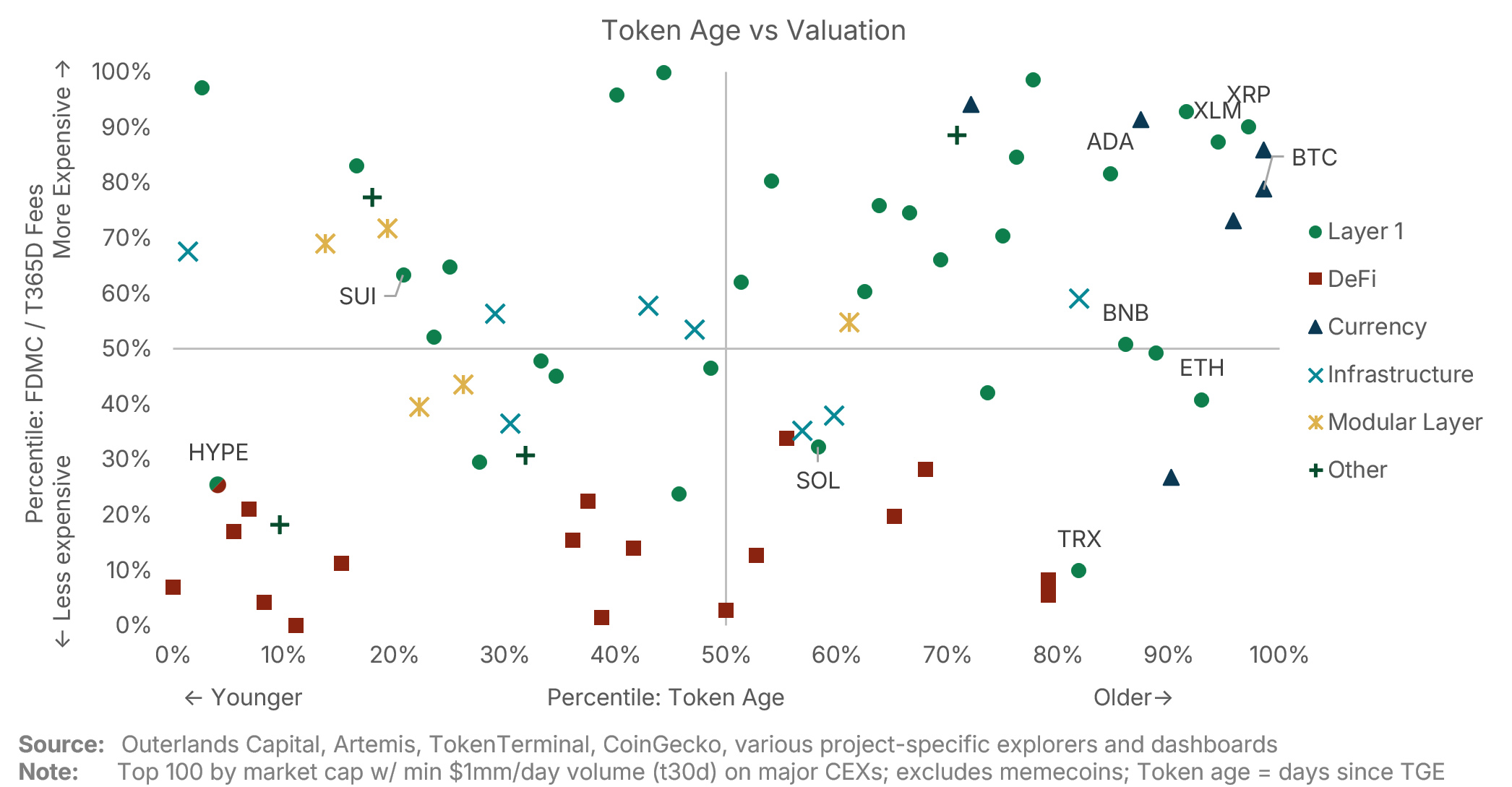

Continuing on the theme of fee-related valuation, we next take a quick look at valuation compared to age (again using fully diluted market cap to trailing 365 day fees, and using days since the token-generation-event for age). A glance at the largest assets by market cap shows a lot of older token projects: The top 10 have an average age of over 7 years, compared to the rest of the top 100 which has an average age of under 5 years. The question being: are projects getting a valuation boost simply because they’ve been around for a long time? In other words: is there a strong Lindy effect in crypto?

Qualitatively, there’s something to be said about a crypto startup simply being able to survive and grow ‘old’ in a fast-evolving industry. End users of projects like Layer 1s may value the security and track record of a well-established project, which could drive expectations of future growth (and, in turn, valuations). However, one might traditionally anticipate valuations to have an inverse relationship with age, with younger projects looking expensive using realized metrics because investors are valuing them on lofty growth expectations.

Looking at the data, it seems that crypto valuations are indeed showing a positive relationship with age. About 30% of projects in our sample fall into the top right quadrant (older, more expensive) and a further 30% in the bottom left quadrant (younger, cheaper). Projects in the DeFi space remain on the cheaper end of valuations regardless of age, while several older L1s and currency projects are trading at high valuations relative to the fees they generate. Although there are plenty of exceptions to the relationship, the data generally suggests that the Lindy effect may carry some weight in the crypto space. Investors do seem to gravitate toward the largest and oldest projects, rather than positioning on deeper fundamentals or nuanced growth expectations.

As we’ve discussed in prior posts (and will continue to explore in future posts), crypto project valuations are driven by a mix of factors, complicated by the turbulence of retail sentiment and hype. We expect long-term valuations to coalesce around fundamentals as institutions move into the space and evaluate projects more like traditional businesses. Correlation does not imply causation, but older projects may be resting on their laurels and we believe need to show proof of real traction and growth to sustain their valuations.

The information herein is for general information purposes only, is not investment advice, and should not be used in the evaluation of any investment decision. An investment in digital assets involves a high degree of risk. Past performance is no guarantee of future results.