Know Your Data

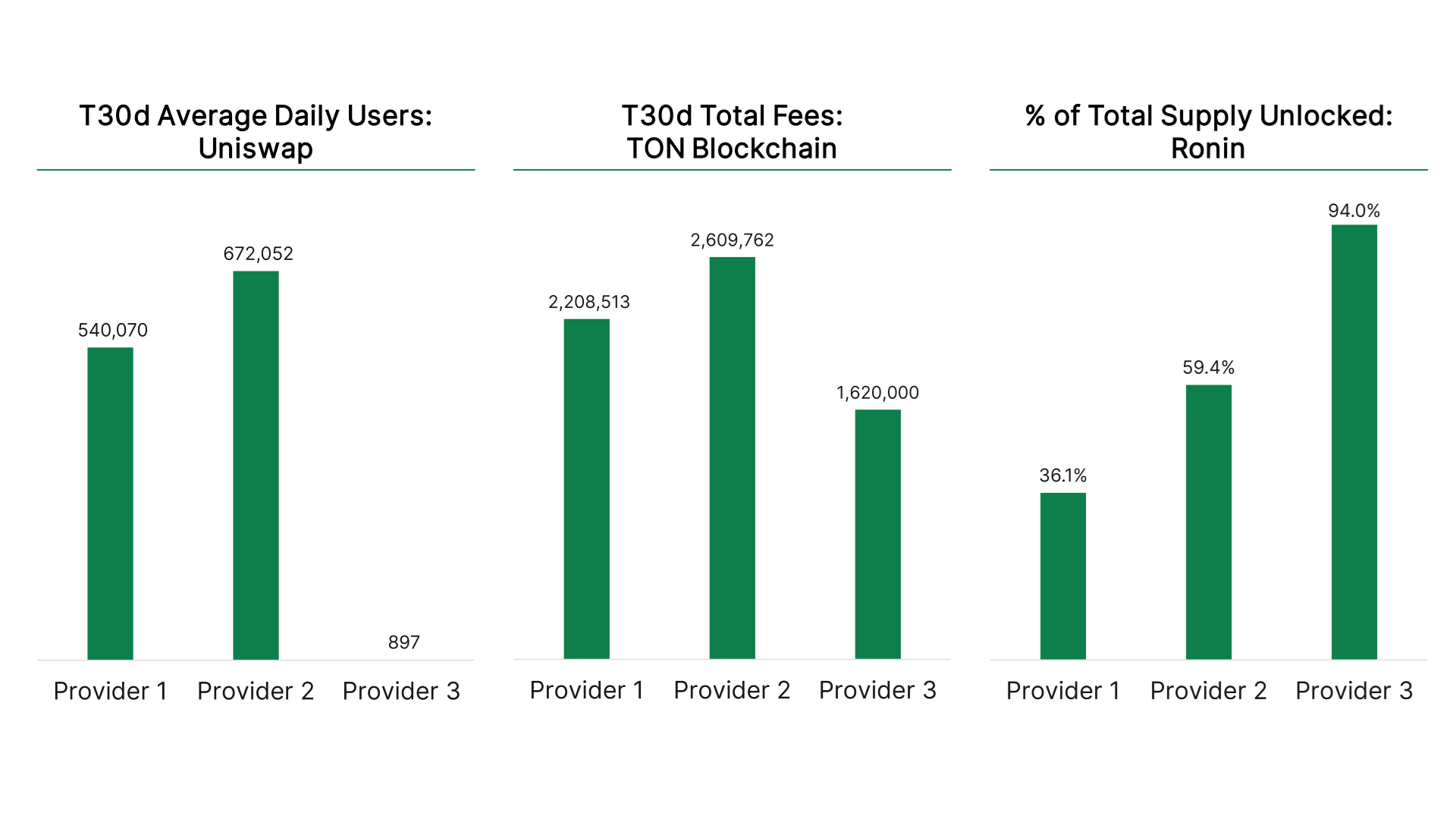

We believe in a fundamental data-driven future for investing in digital assets. However, the data landscape for investors evaluating crypto fundamentals is still evolving. Analyzing a broad universe of crypto projects requires considerable time and effort spent understanding and reconciling different vendors and sources. Each source has its own approach to gathering, calculating, and presenting data, which means the metrics you rely on can vary significantly depending on where you look.

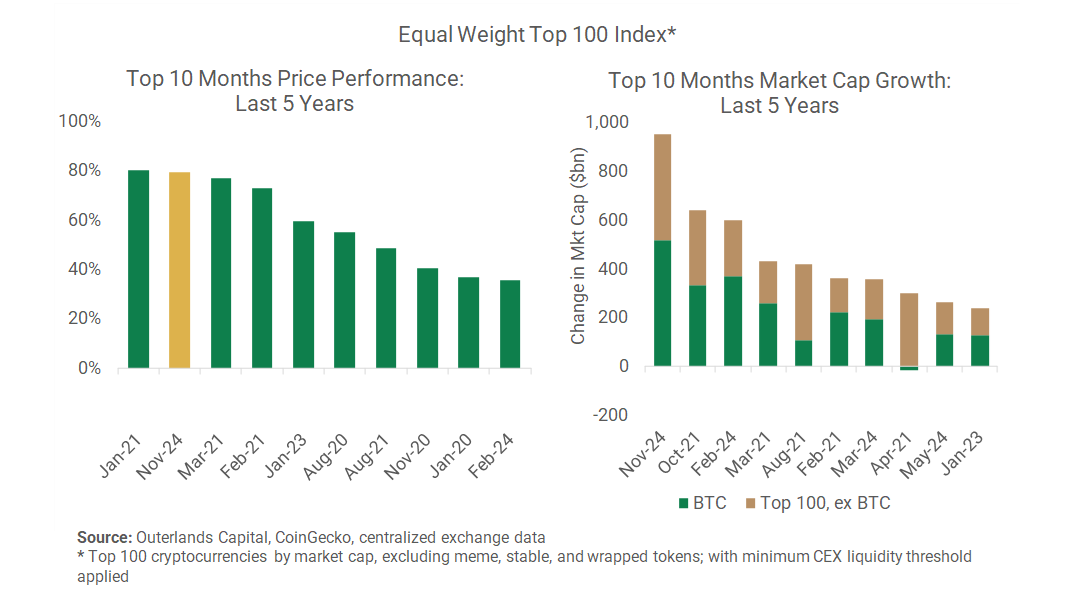

Alt Coins Outperform in November Frenzy

November was a big month for crypto. An equal-weight index* of the Top 100 cryptocurrencies by market cap posted a nearly 80% gain in November, just narrowly missing the top spot for a month's performance in the last 5 years.

Notably, this broader universe of projects outperformed Bitcoin on its own by over 40% (the 4th best level of outperformance in a month in the last 5 years). Impressively, this performance for Bitcoin and alts resulted in record increases in market capitalization, with Bitcoin’s market cap growing over $500bn, and the other 99 projects growing by a combined $434bn, for a total market cap increase of nearly $1trn.

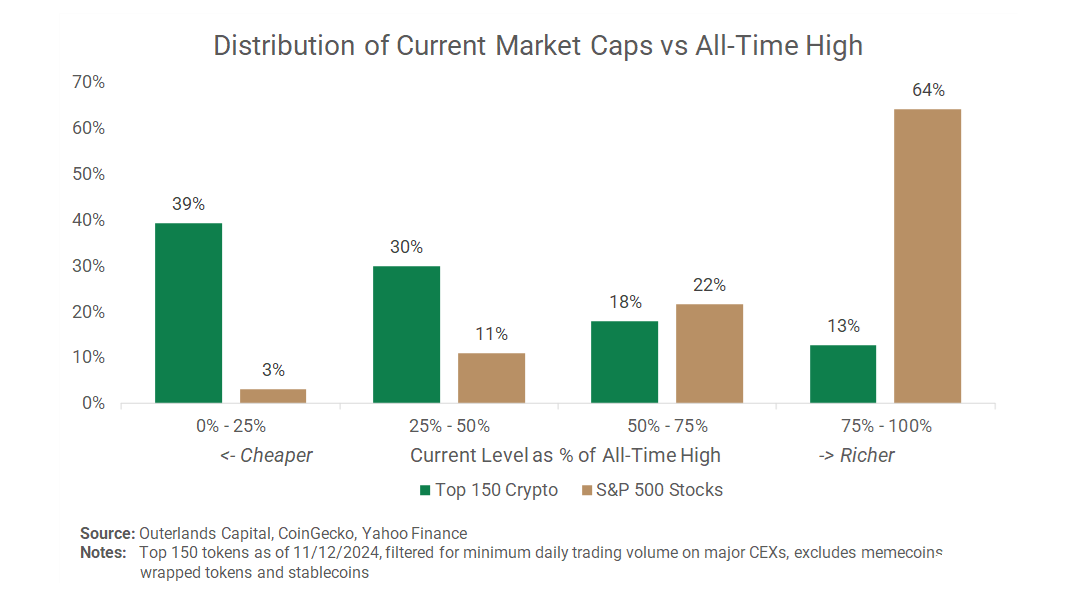

Post-Election Rally Leaves Room to Run

The crypto market’s strong post-US election rally has left some asking if they’ve already missed the bull market. While Bitcoin may be at all-time highs, this isn’t the case for the vast majority of the crypto market.

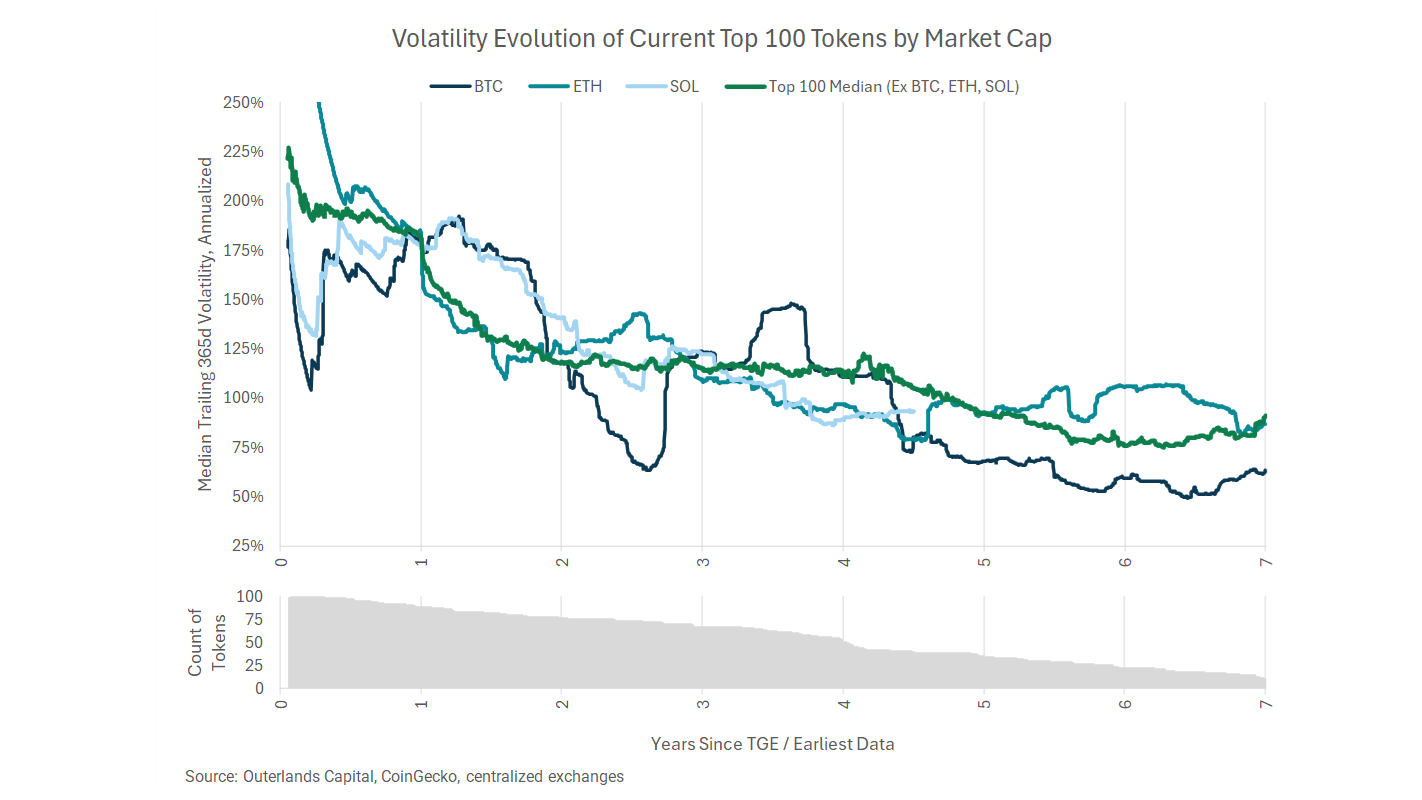

Volatility Evolution for Digital Assets

For institutional investors, volatility remains a key barrier to investing in digital assets. We’ve discussed in the past how the volatility profiles of Bitcoin and Ethereum are now in line with popular tech stocks– but what about the rest of crypto?