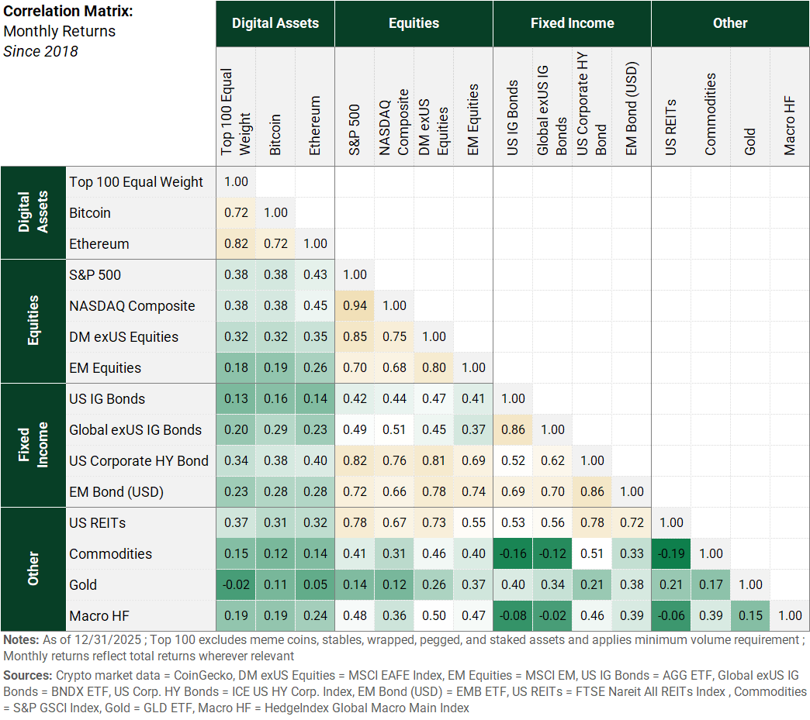

How Correlated are Digital Assets to Other Markets?

Digital assets generally have a lower correlation to equities (~0.33) than equities do to fixed income (~0.60)!

While digital assets are sometimes thought of as ‘just a levered play on the Nasdaq’, the asset class (whether you define it as the Top 100 tokens, just Bitcoin, or just Ethereum) has actually shown low correlations to equity, fixed income, and other markets, over the long run.

However, we believe what matters most is the forward-looking, fundamental reasoning as to why digital assets could outperform other asset classes in an uncorrelated manner. We view an investment in digital assets as an investment in the secular change of money, value, ownership, and business structures over the coming decades. In this context, the market’s growth will be driven by its profound, idiosyncratic potential to disrupt existing businesses and build entirely new products with a global footprint. This should mean that the asset class develops independently of other asset classes and the global macro picture.

We continue to see value in adding digital assets to institutional portfolios, offering exposure to an asset class that could upend the very businesses that underlie existing asset classes.

** The information herein is for general information purposes only and is not investment advice. An investment in digital assets involves a high degree of risk including the loss of principal. Past performance is no guarantee of future results