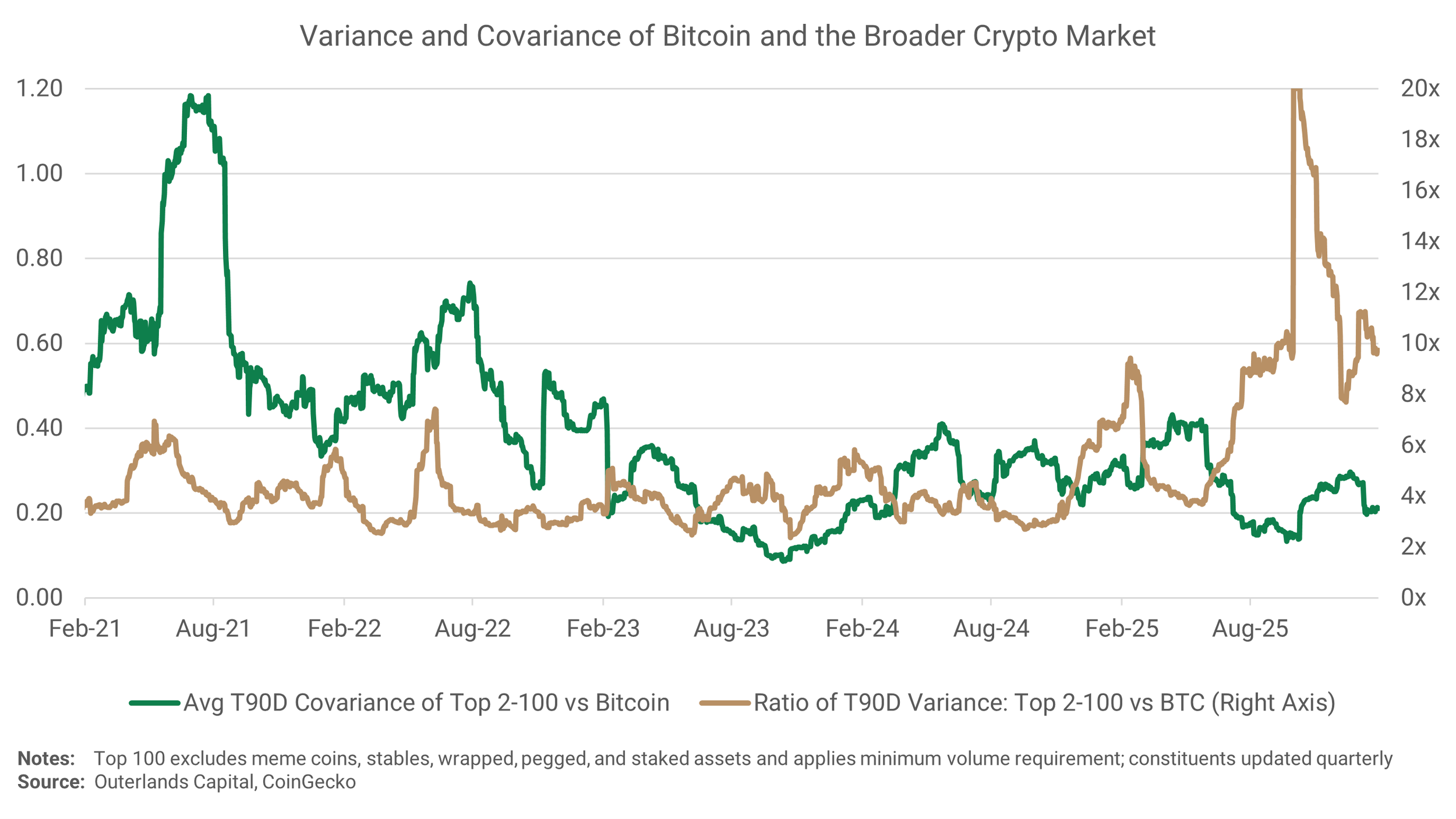

Volatility is Elevated for Alts, but Covariance with BTC Has Fallen

The broader crypto market has been weak for a while now, but one accusation that won’t stick is that everything is just moving with Bitcoin. The average covariance of tokens in the Top 100 vs Bitcoin has actually fallen considerably over the last 5 years (from ~0.5 to ~0.2). However, volatility in the long tail of tokens after Bitcoin has picked up markedly in the last 6 months. Average variance for the top 2-100 tokens is now ~10x higher than for Bitcoin - a marked departure from a relatively steady ratio of ~4x since 2021.

With such elevated volatility, portfolio construction matters now more than ever. We continue to expect a regime where fundamentals matter more, and where markets consistently price differences between networks, business models, and cash flows. Whether or not the market is pricing it now, the right move, we believe, is to select the highest quality assets and remain patient. This is not a ‘shooting fish in a barrel’ type market, a la 2020/21. This is the time to select quality assets for the long run.

** The information herein is for general information purposes only, is not investment advice, and should not be used in the evaluation of any investment decision. An investment in digital assets involves a high degree of risk. Past performance is no guarantee of future results.